Nonprofit Corporation – Set Up a 501(c)3 Fast!

Easy Start NonProfit Corporation Setup Video

See how to get your 501(c)3 setup quick and easy and for the least amount of money… Watch this video to start. There are more resources on this page, but you may not need them all to get going.

*There are lots of video tutorials and tips on this page. Use what you need and when you are ready to proceed, go for it! 🙂

Easy answers to Start a Corporation or Nonprofit Corporation

What State Should You Incorporate or Start an LLC in?

What do I name my Business? -> Free Corporate Name Search

Save $$$ by doing the Article on Tax ID numbers filing yourself!… or not

- Got some Extra time?

- Like to talk to the IRS on the Phone?

- Like to fill out IRS forms?

… If you say no that’s ok!

If you are a tax geek like me and enjoy this stuff, you can spend a couple hours and save $69 by following one of our other tutorials.

Learn more about NonProfit Corporation setups and the Corpnet system

Two Steps to Qualify for the 501(c) tax exemption

- Establish a Nonprofit corporation with Articles of Incorporation, delivered by the state the corporation is established.

- Using the Articles of Incorporation file for the tax exempt status with IRS Package 1023, 1024 or 1028, Application for Recognition of Exemption.

How to Set Up a Nonprofit Corporation in 7-10 Days!

Several friends, clients, and groups have recently asked me ‘How do I get set up with an official nonprofit, tax-exempt organization or charity?‘

I am not a lawyer. The following article is not intended to be used as legal advice.

This simple, practical guide IS here to make it easy to get things done.

GOAL: Put you in touch with people qualified to provide good, easy and fast service, plus some advice where it is needed.

This article on setting up a nonprofit corporation was prompted by the huge response I received from people looking to set up PayPal business accounts as a nonprofit so as to accept donations online.

If you do not have a tax exempt designation, this is for you!

Your organization needs to be officially tax exempt to qualify for a nonprofit account from PayPal AND to get the discounted PayPal rates for Nonprofits. If you have a nonprofit corporation already, but no tax exemption, you can simply set up a typical PayPal Business account and pay higher rates.

Most utilized types of 501(c) Organizations

- 501(c)(3) — Religious, Educational, Charitable, Scientific, Literary, Testing for Public Safety, to Foster National or International Amateur Sports Competition, or Prevention of Cruelty to Children or Animals Organizations

- 501(c)(4) — Civic Leagues, Social Welfare Organizations, and Local Associations of Employees

- 501(c)(7) — Social and Recreational Clubs

- 501(c)(8) — Fraternal Beneficiary Societies and Associations

- 501(c)(10) — Domestic Fraternal Societies and Associations

Once you know you are in the right ballpark, the general steps are pretty straight forward. You simply need to file the right forms and paperwork with the state & the federal government in the right sequence.

The Federal option is only required if you want to be Tax Exempt from Federal Taxes.

If you have ever established an LLC or a Corporation or an S Corp, there are similarities to establishing a nonprofit organization as a 501c or any of the specific tax exempt organizations such as a 501(c)3. The fees and time frames are also similar, but a bit lower in my experience.

Filing Fee Scenarios for nonprofit corporations seeking Tax Exempt Status

- Apply to establish a nonprofit corporation with your state (Typical fee $50 – $250 for service or your attorney’s hourly rate) + additional fees if you wish to expedite the filing

- Pay State filing fees (Typical fee ranges from $8 – $550 + $50 – $300 if you wish to expedite

- Apply for Federal Tax Exemption status (A good step to check with your CPA on!)

- Pay IRS Exempt filing fee based on expected first-year income ($400 – $850)

Each state has different manual filing requirements & fees.

Cost Categories of Filing Fees for nonprofit Corporation Tax Exemption Status

You can expect your costs to break out into a few categories (state filing fee costs, shipping fees (tracking the FedEx or Priority Mail costs and signatures of the tax-exempt organization documents you send in), and the fee, salary or retainer of the person that does all the work if you do this manually).

Since there are so many different types, I’m going to continue this example referring to a 501(c)3, but the steps are the same for the others I mentioned. I’m just trying to reduce the amount of jargon that will follow next.

Steps through the Setup Process with screenshots

Steps to Set up a Nonprofit Corporation

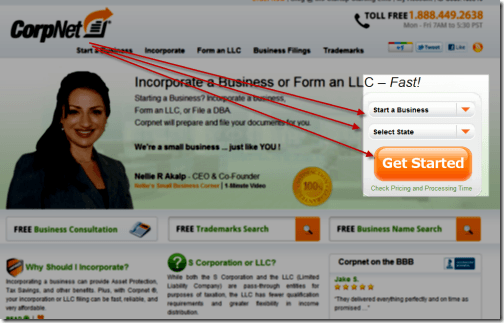

Review how much of the paperwork you want to do yourself versus having it performed for you. There are some elements like establishing a Tax Identification Number that are relatively easy but the actual articles of incorporation should be handled by a pro. If you go to CorpNet and use ( or call and use ID code 185510) they have a quick selection tool that will help you identify what is needed, what the state filing fees are, what if any the state expedited handling fees might be, and if you want them to do some or all of the paperwork for you, a quote appears before your eyes without having to give up any of your information. You can scope a ballpark price instantly and quickly start to determine what your actual expense might be.

- Or from the home page jump right in so that you can see the prices and steps involved in setting up a nonprofit corporation in your area.

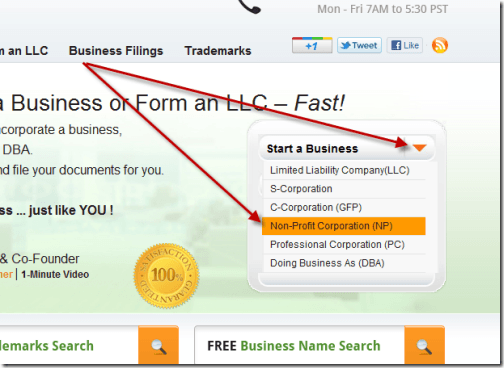

- Select the drop down for Start a Business

- Choose Non-Profit Corporation (NP)

- Then Choose the drop down for Select State

- Find and Select your State, I chose Kentucky for this example, although I personally live in North Carolina. It was simply the cheapest state filing fee.

- Then click the big orange ‘Get Started’ Button

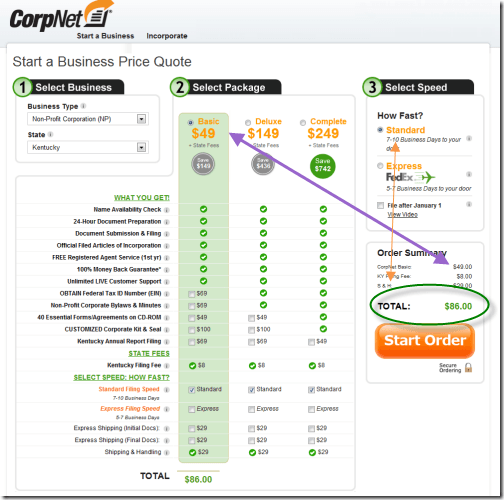

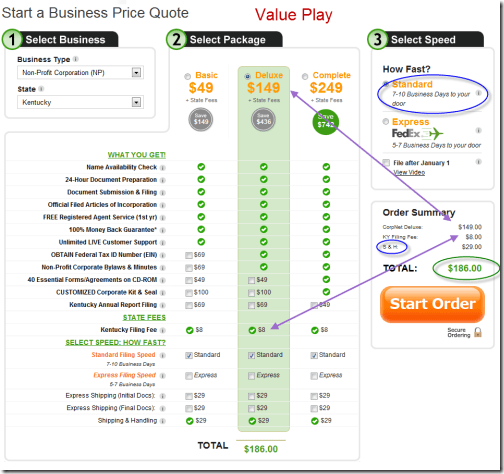

- The first set of prices you will see show the Basic Package with the standard filing speed of 7-10 business days to establish your nonprofit corporation.

- The Basic package fee to CorpNet in this example is $49

- $8 goes to the state of Kentucky

- $29 is for Shipping and Handling

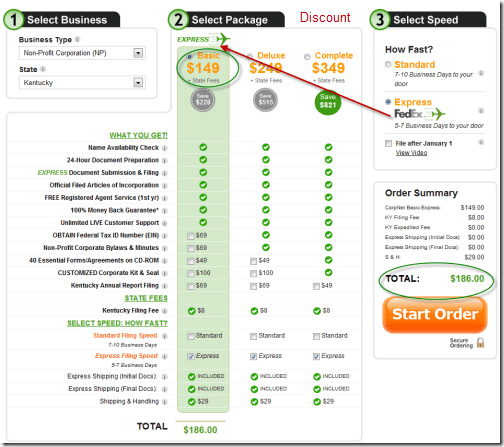

- Alternatively if you want to expedite things, and this doesn’t just include shipping it FedEx but expediting at every level possible, which includes CorpNet responding faster and in some states the State itself fast tracking your application,

- Choose the Express Speed. This will increase the Basic package fee by $100 from $49 to $149. In some states you will also see expedited or fast track filing fees for the states as well

- This selection shows what I think of as the Value Play for incorporating a nonprofit, which adds the Federal Tax ID Number filing plus the nonprofit corporate Bylaws and Minutes.

- I’ve previously shown many people how to set up a TIN themselves, and you might save yourself that fee, but I do recommend the Bylaws and Minutes

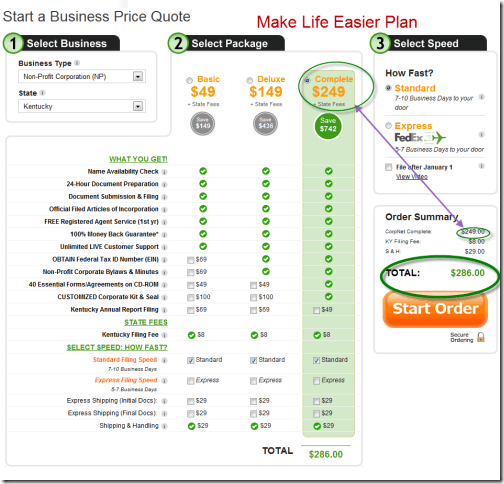

- Then there is what I call the Make Life Easier Plan which throws in the kitchen sink for $249 and at the standard speed, which is still pretty fast imho, that’s a decent bargain and far less than the fee I paid for my first llc by almost ten fold.

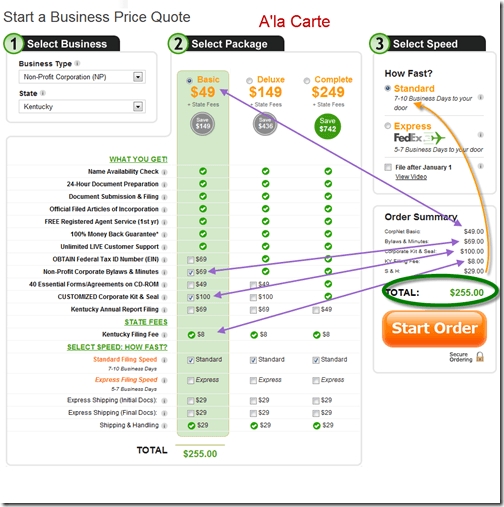

- If I had my own pick of the litter (and you can have that) I’d recommend the following essential items, everything else you might DIY:

- Opt for the Basic Package – $49-$79

- Then choose the Bylaws and Minutes –$69

- Then add the Customized Corporate Kit and Seal – $100 (could be useful for future official documents and getting things set up with your bank, think checks)

- The Kentucky Filing fee – $8 not an option for this state

- and the Shipping and Handling of $29 for the standard speed

- Total cost only $255!

- If I had my own pick of the litter (and you can have that) I’d recommend the following essential items, everything else you might DIY:

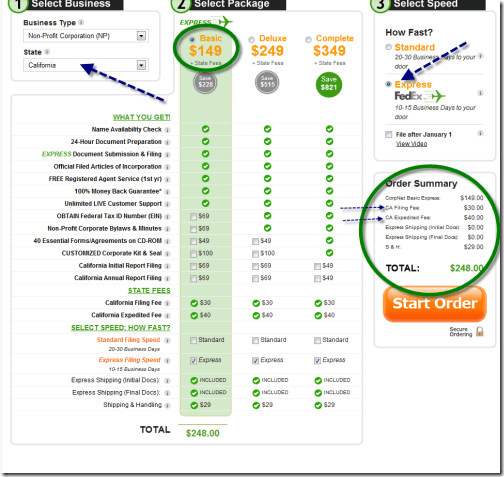

As another alternative, you will notice that once you get to this page you can review rates and options for all 50 states. Here is an example of the fees to establish a nonprofit corporation in California as opposed to Kentucky and to expedite it. The State filing fee in California is slightly higher than Kentucky by $22 for a total of $30. Plus California charges its own fee for expediting, which is $40 and then CorpNet’s expedited package fee for the basic level is $149.

That’s it, once you get your incorporation articles back from your state, then you will be ready to make the big step to applying for exemption from the IRS. There are many benefits including no taxes, and being able to accept

That’s it, once you get your incorporation articles back from your state, then you will be ready to make the big step to applying for exemption from the IRS. There are many benefits including no taxes, and being able to accept nonprofit grants from other nonprofits required to only give grant money to nonprofits themselves. As a trade off the filing requirements for exempt nonprofits is nothing to take casually. There are many good reasons to establish a nonprofit corporation, but you may not need to go the exempt route right away. In general, it’s a good rule of thumb to apply (if you are going to) within the first 2 years.

Learn More about the founder of CorpNet, Nellie Akalp!

FAQs About Nonprofit Organization Setup

What are some of the benefits of establishing an official 501(c)3 tax exempt organization?

If you have already submitted an application to the IRS and you want to know, Where Is My Exemption Application?

What does 501(c) even Mean?

Most people will focus on the types of organizations that start with 501(c)3 all the way through the 501(c)10 with a couple exceptions.

Odds are if you are dealing with any of the others, you will need to just skip this article and contact the closest $500 / hour attorney you can find. Have fun and get your stomach ready for a good lunch. Everyone else, keep reading, you get to save some money.

Other Types of 501(c) Organizations

|

|

I am having trouble finding explicit instructions to incorporate a 501c19 in NYS. I am the Finance Officer for the American Legion Post 46 (the oldest and youngest post in NY) due to inactivity for many years the post lost its TIN and EIIN and does not show-up when searched for on the NYS Department of State website. How do we legally re-constitute this now new (old) post which now has 30+ Nam and Gulf War Vets affiliated?

Hi Roger,

I can’t help with that answer. I suspect you will need to check with an attorney. The first question will be related to whether or not you need a new number or if the old one has to be revived.

My own experience thus far only relates to 501c3 not 501c19, and I suspect you will definitely need an attorney to file for that as well. Maybe you have some existing members that are attorneys? Or maybe you could sponsor a law student with a small scholar ship or something and they might be able to help? There are online services that do enable you to do some types of incorporation online through their services. I do not know if a 501c19 would be included or not. It might require a call or email to one of those services to find out.

they might offer the service, but their online forms may not have that option listed. Might be slightly manual.

Hello..does this kit also include the 501 option?

and also once it is completed do I mail copy off or have online option to file?

How long to get approval back?

Do you guys offer option to complete kit for me?

Thanks!

Hi Kelvin, Softduit does not provide this service. We just provided the review and quick tools to help people find it and get started. I believe that the process is done entirely online, although there might be exceptions in a very few states or areas.

how does a group go about starting a 501 c 10 fraternal organization? I find a whole lot about what they are, but now how to start one!

From the IRS…

see https://www.irs.gov/charities-non-profits/other-non-profits/fraternal-societies