Estimates, Invoices & Getting Paid! Freshbooks vs Quickbooks vs Godaddy Bookkeeping

Whether you use Freshbooks or Quickbooks or Outright or something else, focus on getting the estimate just right, and then stay on top of your invoices and cash flow!

For years, I’ve used Quickbooks to run my estimate and invoicing process. I’d create an estimate send it to a client, wait for feedback, make any adjustments necessary and turn it into an invoice. Its worked well, but it worked very slowly.

Quickbooks now offers PayPal support through a persistent connection.

Quickbooks Self Employed does. You can get started with this by starting the initial import of data from PayPal once you are logged in. From there on, the connection is persistent and data will continue to automatically import from PayPal to Quickbooks.

I used to upgrade Quickbooks every other year. At an average cost of $300 or better per upgrade, not to mention services, Quickbooks cost me a significant amount of money. It never did everything I needed it to do (without paying steep monthly fees for extras) and required a ton of time and work to manage simple things like recording whether or not I got paid. With my new options, I never have to record when I get paid. They record themselves and I pay so much less I laugh at my former self!

How did I do it?

First, I switched to FreshBooks, which doesn’t have a lot of the extra (and unneeded functionality that comes with QuickBooks). Its core functionality is tracking your clients, your estimates, proposals, invoices and payments! Well, that’s just fine with me. I may be an accountant, but that’s not how I earn my keep. Give me a tool that enables me to focus on what brings in the bacon, and I’m happy to sit back and count my clams.

If you need some of that other functionality, don’t miss my updated section below talking about using Godaddy Bookkeeping Online with Freshbooks!

This article has grown and grown and grown over the years. I rewrote it, but felt the updates helped people see the evolution and have changed the ‘updates’ into a ‘history’ section. If you want my quick opinion, skip Quickbooks and go get setup with Godaddy Bookkeeping Online and/or Freshbooks too. I have used both since about 2008 and will never look back!

My initial review has turned into more of a full fledged endorsement.

~ Brett

When's a good time to switch to Freshbooks?

It is easiest to make a switch to Freshbooks just before the beginning of a tax year. The goal is to capture, a full year of income and expense information. Switching a week or two before the start of your next tax year (usually before the end of December for most people) will give you enough time to get all the automated expense tracking accounts connected from your bank(s) and credit card(s) and paypal and other things into Freshbooks. Then next year you will have everything!

Key Difference between Quickbooks vs either Freshbooks or Godaddy Online Bookkeeping

Both Freshbooks and Godaddy Online Bookkeeping capture just enough information to perform Profit and Loss reporting with each online service that keeps track of your cash assets connected and updated in real time so that you can skip balance sheet accounting. They do not perform double entry bookkeeping accounting as you might find or need in Quickbooks or Quickbooks Online. If you must have Double Entry accounting, Freshbooks and Godaddy Bookkeeping Online are probably not going to be a good fit AND someone gets to do a lot of work(add a headcount).

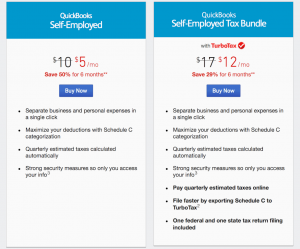

Quickbooks Self Employed on the other hand is a newer niche product that is more comparable to Freshbooks or Godaddy’s Online Book keeping. Its price point is slightly higher than Godaddy Online Bookkeeping by about $2-3 per month if you want the ability to have a Schedule C exported and available for your tax program (Quickbooks offers this to connect to Turbo Tax, their tax product and for the extra $24 per year provides a free federal and state filing. Actual filing software license not included.)

Quickbooks Self Employed offers either a 30 day free trial or a 6 months 50% off offer currently.

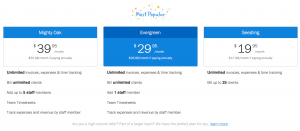

Freshbooks Online Bookkeeping - Buying Tip!

Disclosure - The Plan I Pay for

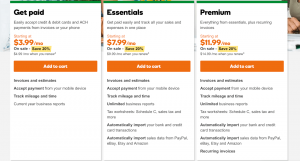

Godaddy Online Bookkeeping - Buying Tip!

Disclosure - The Plan I Pay for

Testimonials from other Freshbooks Users

History of Freshbooks, Godaddy Bookkeeping (Outright)

Some key things we noticed about these services over the years.

Freshbooks Update 2016 – Gravity Forms Integration within WordPress

I originally started using FreshBooks for invoicing and to do things outside of my own website AND I build websites for other businesses.

FreshBooks now has the ability to integrate its services through an API that can connect to Gravity Forms, which is one of the most popular and reliable plugins for WordPress the open source system that we use to build websites for our own clients.

In a simple example, I can sell a service and people can visit Softduit, complete a simple form and ‘checkout’ triggering an estimate or an invoice to be sent from the Freshbooks system!

What can this be used for?

- I can use this to establish a subscription to one of our Service and Support maintenance plans.

- I can enable people to complete something of an RFP form, and return them a line item estimate with real dollar amounts….AUTOMATICALLY!

- If I have a quick basic service that I want to sell as a one off, I can have them complete a form, and have an electronic invoice sent directly to the client, which they can then pay online.

- Lots of other possibilities too!

Freshbooks Update 2014

I still use Freshbooks and have been using them for several years now. They recently added Recurring billing which is proving to be very beneficial for my service based business, helping me grow revenue and simplify the billing process even more. These days, I also use their timers to track time and keep excellent details of every aspect of a job.

They also offer what is turning into a full fledged book keeping service. I do not currently use this as I still use Outright (see below) and had that set up before Freshbooks added everything else. For a new Freshbooks user it might be well worth looking into that option as an alternative to Outright. Although, I personally feel the Outright system is a little more intuitive and you can’t knock free.

Freshbooks Update 2011 – Freshbooks iPad & iPhone Apps

This year I also started using the Freshbooks iPad and iPhone apps. I use these for two purposes. Primarily, I use them for time keeping purposes for clients or projects where I’m working on the clock. It works awesome! I also use the apps from time to time to send an invoice or resend an invoice if something starts to get a little late. My bad debt expenses and late payment expenses have dropped during the last two years significantly. Part of that involves improvements in my sales closing process and general business practices, but I do think the professionalism of the invoices from Freshbooks and the easy payment options plays a big role too!

I am also currently using Outright.com to keep track of my overall general results. Both PayPal and Freshbooks, plus many bank accounts and credit cards connect right into Outright.com. It gives you a big picture view of how your company is doing.

Freshbooks UPDATE October 2010

This month I opted to try a new system, Freshbooks, which is essentially an online invoice service. It makes it easy to manage clients, estimates, proposals, time tracking, project management event through basecamp and more. I just keep it simple and manage my proposals/estimates in Freshbooks. Once an estimate is created, I send it through the Freshbooks system to a client, who can review and approve it. Once approved, I convert it into an invoice and send it back again for an easy PayPal payment on the invoice.

Freshbooks is free to try, once you attempt to invoice more than 3 clients, then you will have to pay a monthly service charge that starts out at $19.95 per month, cheaper than Quickbooks and with less of the things that you probably don’t need.

See Freshbooks in Action for Specific Tasks – Tutorials

Godaddy Bookkeeping Update 2014

I am still using Godaddy Bookkeeping Online (GBO) since the purchase/merger. Prices have stabilized at this point. It is no longer offered on a Freemium price model.

Godaddy Bookkeeping 2014 Prices

The prices are more in line with all similar services or competitors. The average price for the service is and always has averaged around $9.99 per month.

Outright re-named Godaddy Bookkeeping – Update 2013

At the end of 2012, Outright was purchased by Godaddy. The service was mostly free originally. If you wanted to get the super easy and fast tax reporting tools and a couple other little things, they offered a premium service called Outright Plus. The pricing for Outright Plus, frankly confused the hell out of me at first. 🙂 The checkout process now goes through Godaddy and I wasn’t ready for that, when I attempted to upgrade this year and got a little befuddled. Pricing and checkout used to be confusing, but are now straightforward.

Godaddy Bookkeeping formerly known as Outright – Update 2012

As I write this update, it is February 2012. I not only wrapped up my books for 2011 in record time, but thanks to Outright and HR Block software, I got my taxes filed for my business on February 1st!

Outright helped me get my books closed and ready to prepare taxes about 9 months faster than what it used to take me.

In years past, I almost always filed for an extension even when I had a refund coming. Closing out the books for the year always took hours and hours of time, delaying my filing by months. For me, doing taxes in HR Block is not the hard part. Now closing the books for the year is easy too! Plus, I’ve talked with Outright product development folks on the phone several times in the last few months as they seek user input on mobile/iPad app solutions and even more streamlined online business tax tools.

Godaddy Bookkeeping Online formerly known as Outright – Update 2011

This year I dove into the deep end of the pool with Outright. I converted the rest of my book keeping after my online bank did an upgrade and offered a connection.

All of my transactional data now flows through Outright. I classify it for revenue and expense purposes.

It captures just enough information to perform Profit and Loss reporting with each online service that keeps track of your cash assets connected and updated in real time so that you can skip balance sheet accounting. It does not perform double entry bookkeeping accounting as you might find or need in Quickbooks or Quickbooks Online. If you must have Double Entry accounting, Freshbooks and Godaddy Bookeeping Online are probably not going to be a good fit AND someone gets to do a lot of work(add a headcount).

It’s exactly just enough of what I need to stay on top of everything, and easily see exactly where I am for revenue and profitability at any given time. Combining this with my Freshbooks account is flat out awesome! If I had more paper transactions, I’d even connect it to Shoebox and for a couple bucks a month those entries would be done for me as well.

I spend less than an hour a month on book keeping! (probably closer to 20 minutes but I thought I’d be conservative in my estimate)

Outright makes it VERY easy to start using them for free with no hooks, no credit card required or anything. I would say that it is probably easier to start at the beginning of your year than more than halfway through, but boy is it cheap and easy. Even once you pay (about $9 a month), that is so ridiculously low, you’ll wonder why you waited. Its services like these that make me happy I left the accounting profession, because there is no way that people can compete with a service this good and inexpensive!

Who Uses Freshbooks Videos

Who Uses Godaddy Bookkeeping Online? How do they Use it?

What I used to think of QuickBooks online before I found Godaddy Bookkeeping and Freshbooks

For more professional estimates and invoices I utilize QuickBooks Online. It costs $25 a month and I never have to futz with software upgrades, which is something to consider with Quickbooks off the shelf.

I am an accountant myself, so Quickbooks is not intimidating. That said, if you do not have a background in book keeping, accounting or finance, Quickbooks may be overkill. On a side note, Quickbooks Online currently only works with Internet Explorer.

How to Manage Your Estimates, Invoice, & Billing and Get Paid working Online

Odds are if you are doing some form of work online, eventually you will do more than just write articles. You might take a ghost writing job, try your hand at web design, SEO or SEM work, or even Video SEO. Maybe you will even start a consulting business.

There are a couple basic things you need. The first is an address for receiving payment. I recommend a PO Box or UPS Suite, but sometimes you must have a bank account or physical address.

The second thing is a PayPal account. This has come up before, but these days it is absolutely essential!

PayPal does give you the ability to send invoices electronically direct from PayPal. Personally, I’ve used this for transactions ranging from $5 – $25,000! It works. But I prefer to offer something more professional when I can.

Epiphany & Tax Filing Update – 2012

It’s December 26, 2012 as I write this update and I’m still using Outright to keep track of my business books. Life is easy that way. 🙂

This will be proved out in just a couple days when I file my business and personal income taxes. Nothing could be easier for me now since I let Outright automate the majority of my book work.

I like doing taxes. I even worked for H&R Block preparing tax returns in the 90’s after getting out of the military.

These days I use H&R Blocks software to file my own taxes. There are two ways of doing this. You can complete your return online through them, or you can pay a few extra bucks, download the software and do the same thing. I generally download it. I personally prefer having the software on my machine. I also help my in-laws prepare their taxes as well and with the software package I get, I am allowed to file up to 5 federal returns when I get the software. Regardless, do not pay the full price. If you click the link/image below you will see the discounted price for H&R Block whether you fill your return out online, or buy and download the software.

When starting, It definitely makes sense to make the switch near the start of your business year or new tax year. This was your new year’s worth of transactions can flow into the new system and you will not need to manually export/import data or key anything in!

Related articles on Accounting alternatives to Quickbooks such as Godaddy Bookkeeping and Freshbooks for invoicing online

- How to Export Your Chrometa Time Entries into FreshBooks (chrometa.com)

- FreshBooks Announces Integration with SalesForce for Easy Invoicing (readwriteweb.com)

- Autotask Announces Integration with FreshBooks’ Online Billing and Invoicing Software — Seamless Integration Allows End-to-End IT Business Management in the Cloud

Disclosure – Helping the Outright team with their project

The phone interviews were supposed to be of the type where they ask me a bunch of survey questions about how I use Outright and in exchange I would receive a $50 Amazon card. I talked with them 3 times and was supposed to receive 2 cards. For what it’s worth I was happy to speak with them but never received the cards. I did test the new iPhone app for Outright under development at the time too. I just noticed that the new free Outright iPhone app is available in the App store. It does require an Outright account.

Cloud Accounting and Online Invoice Tool Alternatives

Free PDF Invoice Creator from Freshbooks

In November of 2014 Freshbooks contacted me to let me know about a new free invoice service ( http://freeinvoicecreator.com/ ) they offer. Its not the full Freshbooks, but it is free. A bit of a freemium offering for those that want to see what the invoicing portion looks like. It will let you create an invoice, save it as pdf or send it to your client via email. It will not (like regular freshbooks) let your client make a payment online. This probably should not be viewed as a total solution, but as a way to either create a quick one off invoice or as a method to test drive a small part of Freshbook’s online system.

I put together a short video, showing the basics of the invoice creation capability, although since I already have a Freshbooks (paid) account set up, I did not follow through and create the sign in for a new account at the end, mistaking that for something else.